Over the years, the cost to process Invoices has changed. The way that Invoices are processed within a business has also changed. Invoice processing has grown for most businesses from a small group of people manually entering data to whole departments that deal with Credits, Payables and Finance. Invoices can can trigger multi-step workflows, spawn other processes that involve managers and executives and can be included in multi-document matching (referred to as “3 way matching”).

What is not usually looked at is the cost to process an Invoice. This includes a review and understanding of the human “hands” that touch an invoice. After review, there are usually simple changes to the process that can simplify and make efficient the flow of the Invoice. Printing a PDF to enter the data is a definite no no to!

What’s important to realize is that the actual cost to process the data from the Invoice can be expensive just by looking at who is actually processing (or ‘keying’) the data. These can be expensive accounts staff that are better served in other areas of the Finance department. It could be that there are large teams that are used in a reactionary scenario – at the end of the month, all hands on deck and then scale back.

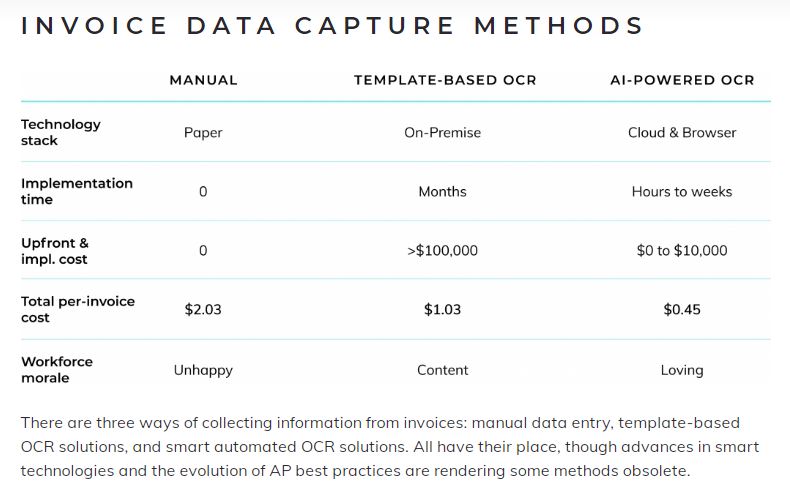

There are 3 generally accepted methods of data capture. From manual entry to Artificial Intelligence, businesses will adopt the method that best fits what they need. Looking at the table below and focus on the ‘Total per-Invoice Cost”, the metric that needs to be coupled with this is the volume of Invoices. Processing 100 Invoices per month will cost a lot less than 1,500 Invoices.

Notice the last line – Workforce morale.

MANUAL DATA ENTRY

Here’s a breakdown of a typical manual invoice data entry process:

Receive paper invoice. Open accounting software. Look at paper invoice. Enter PO number into header field for PO number in accounting software. Look at paper invoice. Enter vendor name into header field for vendor name in accounting software. Look at paper invoice….

You get the idea. We could replace “paper invoice” with, say, “pdf invoice”, the difference being that the data entry clerk copy-pastes invoice details into accounting software instead of typing them. Day after day after day.

Manual data entry in any context is clearly a tedious spirit-draining task, regardless of whether your company outsources it or keeps it in-house. And as the spirit wanes, the potential for errors rises. As melodramatic as that sounds, it’s true, and the fact remains that manual invoice data capture can create all kinds of problems, including late payments, lost early payment discounts, and friction with vendors.

OCR

With the arrival of OCR came the hope of dramatic reductions in man-hours spent on invoice data extraction. OCR software scans printed documents, or reads electronic documents, and collects the text contained within them. AP professionals use this solution to capture invoice data, which they then process and store.

There are two OCR variants: template-based and automated. Template requires manual effort to maintain and prevent errors; automated offers the option of running an accurate and efficient touch-less AP process.

Template-based OCR

In this approach to data capture, OCR software reads an invoice and captures data according to predefined rules and templates. It has come a long way in its decades-long history as the go-to solution for digital invoice processing. Template-based OCR extracts data more accurately now, just as long as the software is reading characters in layouts it’s been trained to understand. This means your AP colleagues must set up templates and rules for every format of invoice they receive.

If your business has all its suppliers submit invoices with the exact same layout, this is a pretty feasible solution. However, the invoices your company’s AP unit is processing are more likely to be formatted differently. And at least one staff member has to handle such tasks as accuracy verification, PO matching, and initiating approval and payment processes.

Smart OCR invoice scanning

A smart OCR invoice scanning platform understands the information it is extracting. Applying machine learning technology, the software learns how to recognize and capture relevant data in various document layouts with continued use. This eliminates the need to manually set up new templates every time the AP team receives new invoice layouts. This is about as “set it and forget it” as an invoice data capture service can get.

You can set up a smart OCR invoice scanning solution to fully automate AP data entry. You could even go so far as to create a completely touch-less AP process if your business is comfortable with having software approve invoices. However, the reality is that you’re always going to need a human in the loop to monitor accuracy and ensure every step is running smoothly.

While an automated invoice data capture solution may seem like an obvious upgrade for AP, finance professionals are understandably a bit wary about progressive technologies like AI and machine learning, as well as the very idea of cloud-based SaaS solutions. If you’re committed to introducing cognitive data extraction to your company’s AP workflow, you might need to put some extra effort towards getting buy-in from your company’s decision-makers.

STRUCTURED VS. SEMI-STRUCTURED DATA

Documents with structured data are identical in terms of structure and appearance. Information is categorized, labeled, or positioned clearly. For example, the fields in a multiple choice test are going to be laid out exactly the same for every student taking the test. So a traditional template-based OCR solution can easily process documents with structured data, with minimal setup and maintenance requirements.

Invoices, on the other hand, are semi-structured documents, meaning they have the same basic structure but may have different layouts and content. They contain certain constants, such as date, vendor name, and total amount due; they also have a number of variables, including line items, discounts, or penalties. The location of each header field may also differ greatly from invoice to invoice. In this case, a template-based OCR solution can waste man-hours and cost, and increase the potential for errors. A smart OCR scanning platform, however, gets better at processing semi-structured documents with continued use. To get the best possible results, make sure your solution includes Machine Learning (“ML”). Machine learning should be as automatic as possible – you don’t need to burden your users with extra steps that are not related to efficiently processing the Invoice. The system should ‘monitor’ human interaction and react to those changes – learning as it goes.

HELP GROW YOUR BUSINESS WITH BETTER INVOICE DATA CAPTURE

When considering which areas of your business could use an upgrade, take a good look at your company’s AP process. You might find opportunities to introduce efficiencies, boost productivity, and cut costs across departments simply through improved invoice processing. Of the technological solutions that can help you achieve this, Make sure you spend some time looking into specialized intelligent invoice data capture software. A smart OCR invoice scanning platform that automates accounts payable data entry could end up being vital to helping your company achieve its strategic objectives.

Whether you’re just coming to understand the undeniable benefits derived from invoice automation, facing the fact that current processes won’t support future growth, or maybe an early adopter recognizing that what was once cutting edge is no longer cutting the mustard—it may be time to kick off an improvement project in your AP.

Look closely at the platform used to deliver your solution – using the Cloud is a flexible solution. Your I.T. department does not worry about servers or software updates. Integration for your users is usually straight forward and the results are as good as an On Premise Solution.